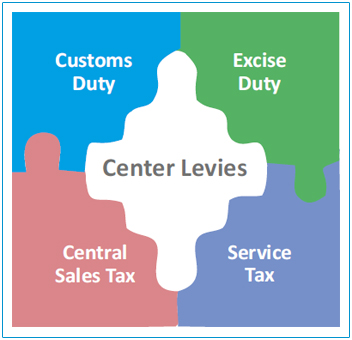

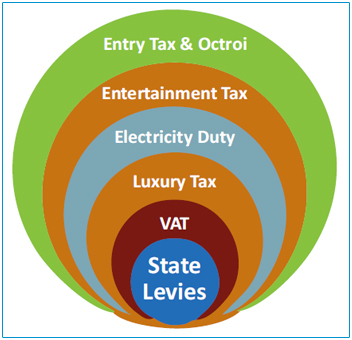

At present, the taxes levied by center and state are different. The center levies custom duties, excise duty, central sales tax and service tax. Whereas, the state levies VAT, luxury tax, electricity duty, entertainment tax, entry tax, and octroi.

GST structure is expected to have two components: One levied by the Centre - Central GST (CGST), and the other levied by the State - State GST (SGST). Both components would be applicable on all taxable transactions of goods and services. The Centre and the States would have simultaneous jurisdiction for all tax-payers in the value chain. The CGST and the SGST would be levied simultaneously on every transaction of goods and services, except for the services and goods which are beyond the purview of GST.

| Return Form | What to file? | By Whom? | By When? |

| GSTR - 1 | Details of outward supplies of taxable goods and/or services effected | Registered Taxable Supplier |

10th of the next month |

| GSTR - 2 | Details of inward supplies of taxable goods and/or services effected claiming input tax credit. | Registered Taxable Recipient |

15th of the next month |

| GSTR - 3 | Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax. | Registered Taxable Person |

20th of the next month |

| GSTR - 4 | Quarterly return for compounding taxable person. | Composition Supplier |

18th of the month succeeding quarter |

| GSTR - 5 | Return for Non-Resident foreign taxable person | Non-Resident Taxable Person |

20th of the next month |

| GSTR - 6 | Return for Input Service Distributor | Input Service Distributor |

13th of the next month |

| GSTR - 7 | Return for authorities deducting tax at source. | Tax Deductor |

10th of the next month |

| GSTR - 8 | Details of supplies effected through e-commerce operator and the amount of tax collected. | E-commerce Operator/Tax Collector | 10th of the next month |

| GSTR – 9 | Annual Return | Registered Taxable Person |

31st December of next financial year |

| GSTR - 10 | Final Return | Taxable person whose registration has been surrendered or cancelled. |

Within three months of the date of cancellation or date of cancellation order, whichever is later. |

| GSTR - 11 | Details of inward supplies to be furnished by a person having UIN | Person having UIN and claiming refund | 28th of the month following the month for which statement is filed |

All these returns are required to be filed digitally online through a common portal to be provided by GSTN, non-government, private limited company promoted by the central and state governments with the specific mandate to build the IT infrastructure and the services required for implementing Goods and Services Tax (GST).

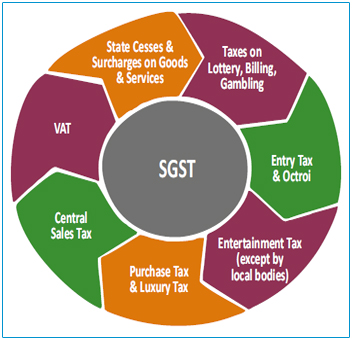

Following are the taxes, proposed to be subsumed under the dual component structure GST: